free cash flow yield private equity

For a given time period DPS can be calculated using the formula DPS D - SDS where D the amount of money paid in regular. Corporate funding of private equity firms witnesses higher-than-normal debt proportions instead of equity or cash.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow 227 million 32 million 65 million 101 million.

. The free cash flow conversion rate measures a companys efficiency at turning its profits into free cash flow from its core operations. Determine the dividends paid per share of company stock. It works for private businesses publicly traded stocks projects real estate and any other investment that is expected to produce cash flow later in exchange for cash flow today.

Equity investors are their own worst enemies. Free Cash Flow Conversion Rate Formula. Use due diligence financial modeling techniques and valuation methods Valuation Methods Discounted cash flow comparable company analysis.

Free Cash Flow 550 million 100 million 175 million. This represents the amount of dividend money that investors are awarded for each share of company stock they own. Free Cash Flow 93 million.

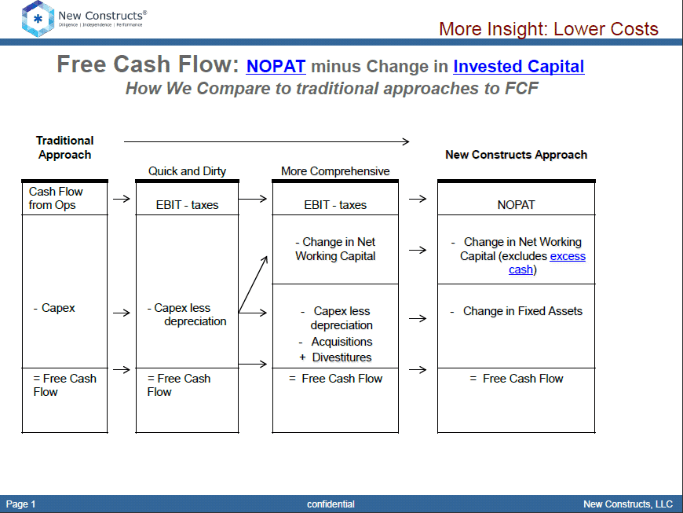

Terrance Odean tells why. Explanation of Free Cash Flow Formula. The idea here is to compare a companys free cash flow to its EBITDA which helps us understand how much FCF diverges from EBITDA.

Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. We will keep an eye on them and I am praying that we see these tech companies becoming money spinners both in the free cash flow sense of the word and in the stock price sense of the word. Free Cash Flow 275 million.

Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018. If you want to apply it to stocks check out StockDelver which is my digital book and streamlined set of Excel calculators for valuing stocks. Free Cash Flow can be defined as the cash flow available to the firm net of any funds invested in capital expenditure and working capital for the year.

It considers the expected dividend yield on the underlying asset. A Private Equity Analyst or PE Analyst is a person who works primarily for private equity firms and conducts research does ratio analysis and gives interpretations on private companies. If a private equity firm wants to quickly decide on a minor investment in its portfolio they may default to a simple DCF model using Free Cash Flow.

In finance discounted cash flow DCF analysis is a method of valuing a security project company or asset using the concepts of the time value of moneyDiscounted cash flow analysis is widely used in investment finance real estate development corporate financial management and patent valuationIt was used in industry as early as the 1700s or 1800s widely discussed in. Find your companys dividends per share or DPS value. Who is a Private Equity Analyst.

The formula for calculating the FCF conversion ratio. A company with debt will have a higher unlevered FCF yield. Cash Flow Formula Example 2.

This impacts the companys cash flow and net profit and may lead to lower Earnings Per Share EPS EPS Earnings Per Share EPS is a key financial metric that investors use to assess a companys performance and profitability. FCFE or free cash flow to equity measures the amount of cash remaining for equity holders once operating expenses re-investments and financing-related outflows have been accounted for. Since FCFE represents the cash left over after meeting all financial obligations and re-investment needs to remain operating such as capital expenditures CapEx.

Hence the Free Cash Flow for the year is 275 Million. This model compares the dividends paid to what a firm could have paid by estimating the free cash flow to equity the cash flow left over after net debt payments net capital expenditures and working capital investments. You will find.

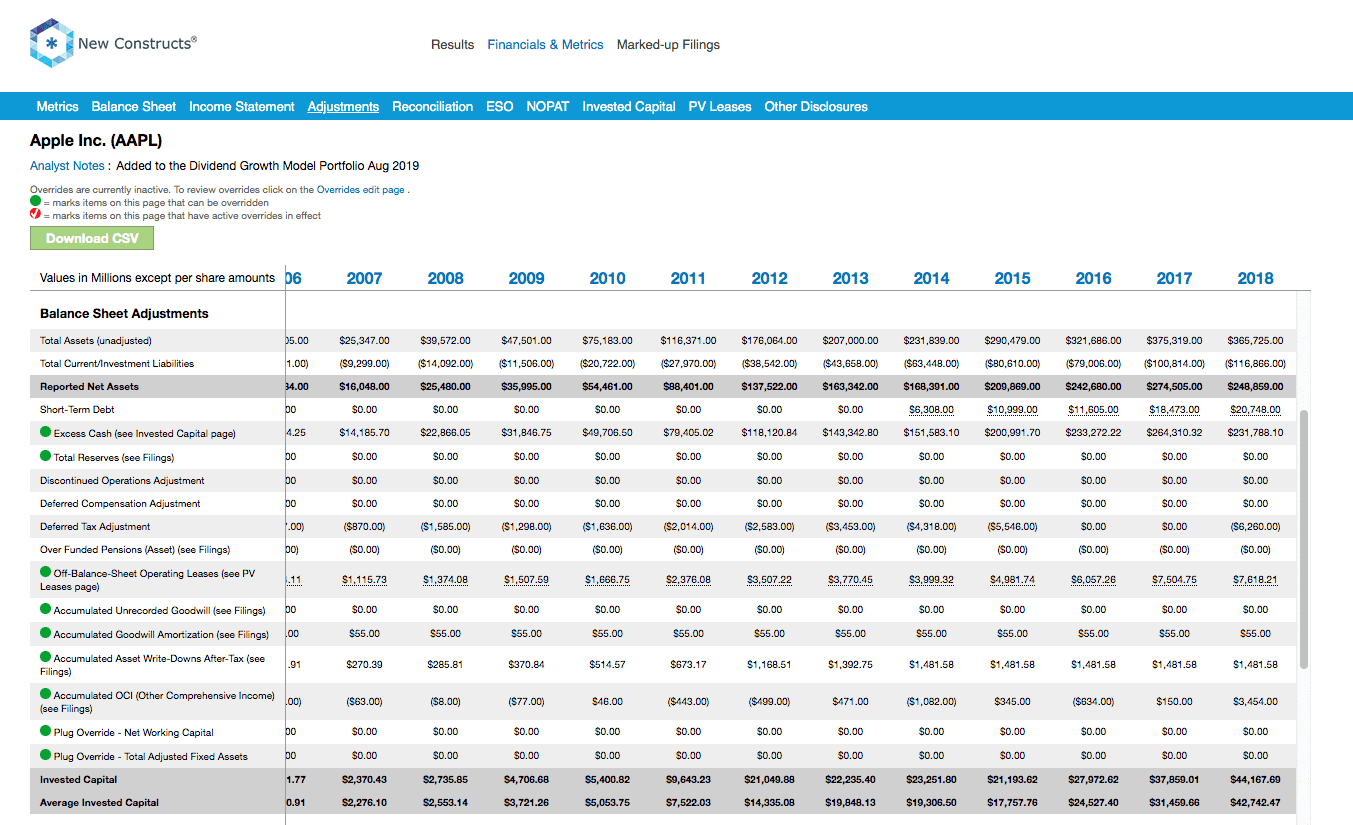

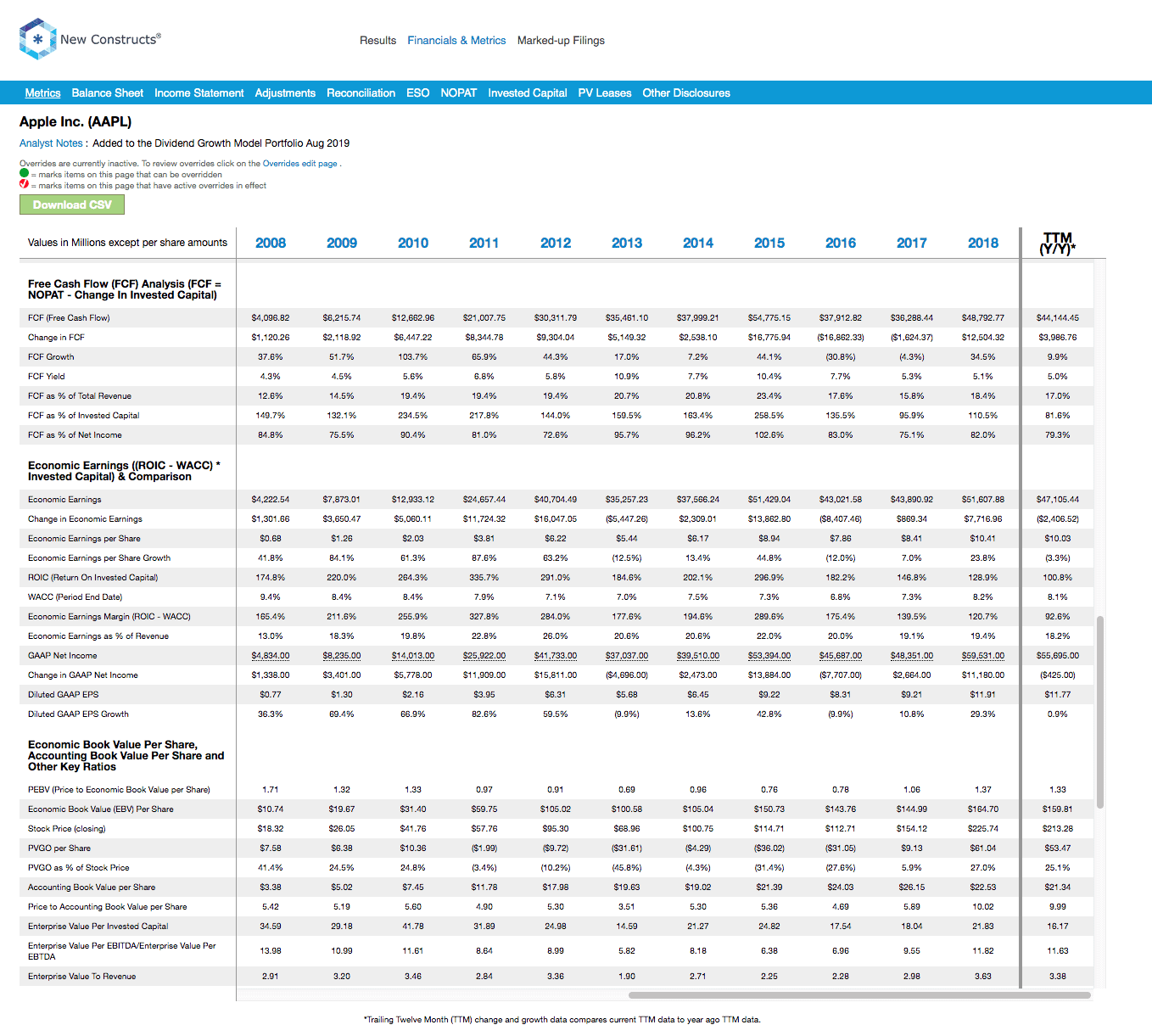

Education Metrics Fcf New Constructs

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

Free Cash Flow To Equity Fcfe Formula And Calculator Excel Template

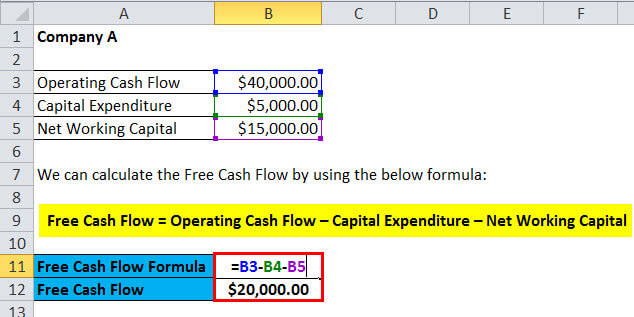

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Explained

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Education Metrics Fcf New Constructs

Education Metrics Fcf New Constructs