nanny tax calculator florida

This is a sample calculation based on tax rates for common pay ranges and allowances. Use a nanny tax calculator to get a clearer picture.

The 10 Best Nanny Payroll Services 2022 The Baby Swag

For specific advice and.

. Our new address is 110R South. A nanny tax calculator will help you learn what your take-home pay will be when negotiating your pay rate. If youre moving to Florida from a state that levies an income.

Include the FUTA tax for the employee on your Form 940 or 940-EZ Employers Annual Federal Unemployment FUTA Tax Return. FLORIDA LABOR LAWS Minimum Wage. They can provide you with a fully comprehensive nanny payroll service as well as advice and full legal support relating to the employment and pay of your nanny.

Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare. Nanny Tax Hourly Calculator.

Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. These taxes are collectively known as FICA and must be withheld from your nannys pay. Well answer all your questions and show.

Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. This calculator is a. 005000 Local tax paid.

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. Determine Your Tax Obligation.

GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes.

If you report the employment taxes for your household. Cost Calculator for Nanny Employers. This calculator assumes that you pay the nanny for the full year.

GTM Can Help with Nanny Taxes in Florida. Taxes Paid Filed - 100 Guarantee. Your household income location filing status and number of personal.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Florida defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal. Federal tax paid.

The Nanny Tax Company has moved. Nanny tax calculator for nannies. There is a difference between net and gross pay.

It is intended to provide general payroll estimates only. Overview of Florida Taxes. Call 800 929-9213 for a free no-obligation consultation with a household employment expert.

If you make 55000 a year living in the region of Florida USA you will be taxed 9295That means that your net pay will be 45705 per year or 3809 per month. 01500 State unemployment employee. 000070 State tax paid.

Employee State Tax Settings. You may have seen this type of calculator on the internet when trying to look for information on how to pay nanny tax to the Internal Revenue Service IRS. Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no.

File this application to establish a Reemployment Tax. 002000 Extra per check. Nanny payroll help can vary from low-cost or free DIY resources to full.

You can also print a pay stub once the pay has been. As an employer you are obliged to enrol your employee onto a pension scheme. Florida has no state income tax which makes it a popular state for retirees and tax-averse workers.

Social security nanny. It is then the decision of the employee whether they opt in or out of the scheme you cannot choose for. Your average tax rate is.

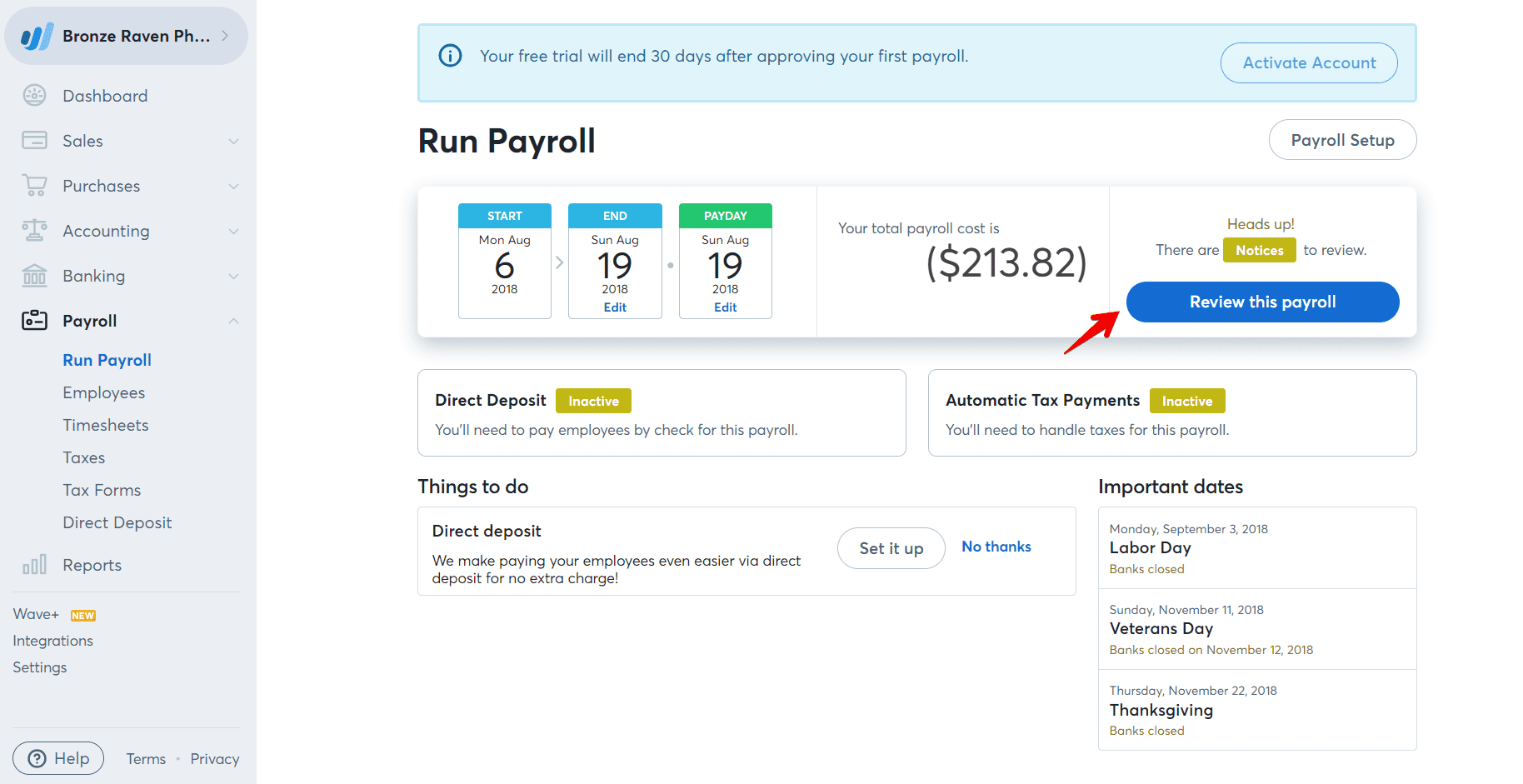

Youll owe 765 percent of what you paid your nanny in FICA taxes as well as six. Nanny tax payroll service for calculating taxes and providing documentation like paystubs and W-2s. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Your individual results may vary and your results should not be viewed as a.

.png?width=800&name=2017%20W-2%20FORM%20(2).png)

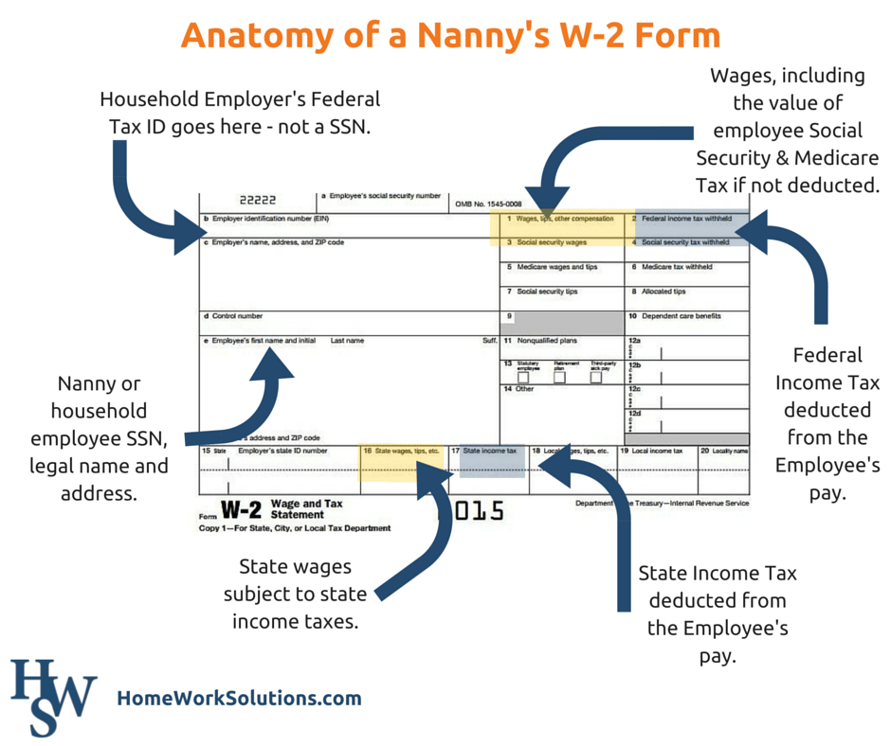

W 2 Reporting Required For Nanny Tax Free Healthcare Benefits

Nanny Tax Payroll Calculator Gtm Payroll Services

The Right Time To Put A Nanny Or Caregiver On The Books Hws

How To Do Payroll Yourself In 8 Steps Youtube

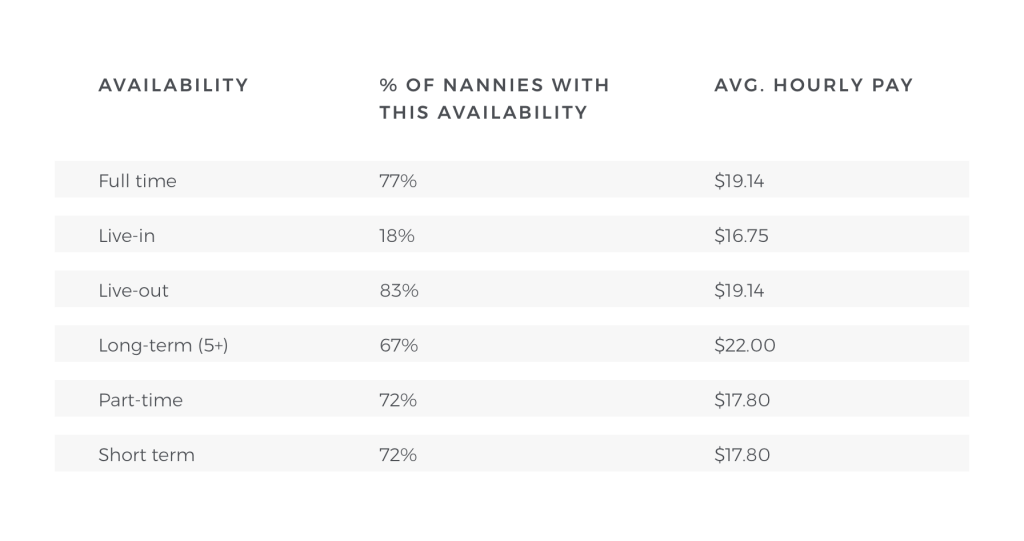

How Much Do I Pay A Nanny Nanny Lane

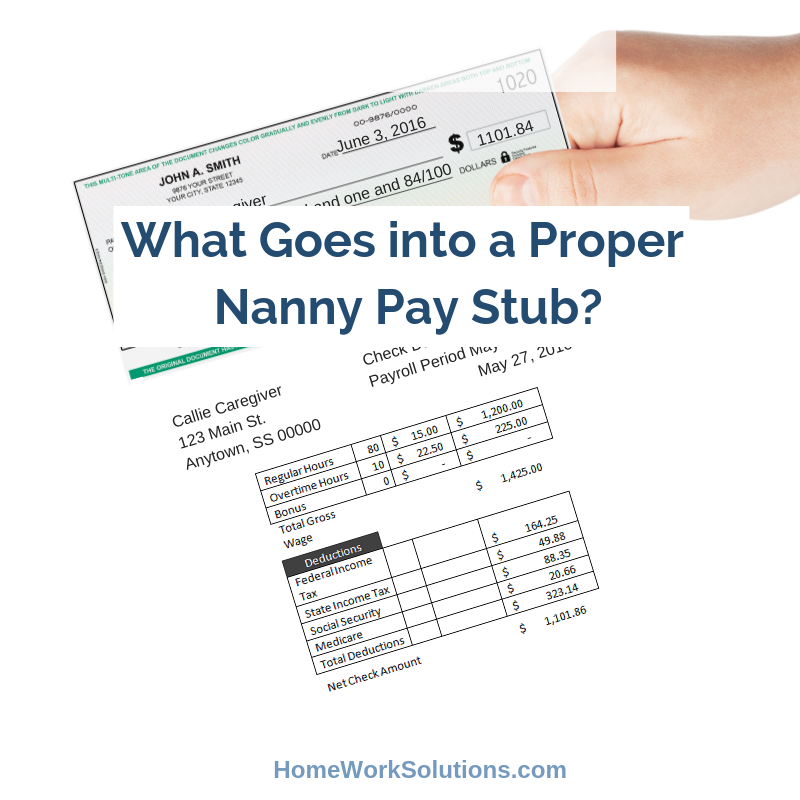

What Goes Into A Proper Nanny Pay Stub

Nanny Tax Calculator Gtm Payroll Services Inc

Common Nanny Tax Questions Poppins Payroll

How To Pay Your Nanny S Taxes Yourself Nanny Tax Payroll Template Nanny Payroll

Nanny Tax Calculator Gtm Payroll Services Inc

A Nanny Asks Questions About Form W 2

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Full Service Nanny Tax Solution Poppins Payroll

How Does A Nanny File Taxes As An Independent Contractor

Florida Tax And Labor Law Guide Care Com Homepay

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculator Nanny Pay Calculator The Nanny Tax Company